It also incorporates tone of voice, body language, and facial expressions. However, there is actually an underlying, subtle message given from the sender’s child or parent state, to be received by the responder’s child or parent state. When this complementary transaction happens from an adult-to-adult state, it is thought to be the best type of communication, as it is respectful and reduces conflicts. The three states of child, parent, and adult affect how we receive, perceive, and respond to information or communication from someone. The free child ego state can be creative, spontaneous, playful, and pleasure-seeking.

Schramm Communication Model: the Basics and Elements

Whereas the child and parent state may be driven by past experiences and conditioning, the adult state considers the here and now situation. These life scripts have a profound effect on how we think, feel, and behave. We are conditioned to respond in a certain https://www.bookstime.com/ way, based on the results we have achieved with that type of behaviour before. A crossed transaction, on the other hand, occurs when two people are communicating in a way that is not consistent with their self-concepts or roles.

What techniques are involved in transactional analysis therapy?

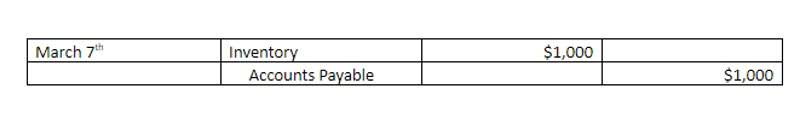

Nayeri, Lotfi, & Noorani (2014) provided 15 couples with group transactional analysis sessions. A complementary transaction takes place when the lines between the sender’s and receiver’s ego state are parallel. The adapted child state conforms and acts according to others’ wishes to please them and be seen as good and liked. Still, it also has a rebellious side when faced with perceived conflict and causes responses of resistance, hostility, and emotional reactivity. In the second step, the nature of accounts identified in the first step is determined. For example, in the above transaction of Robert Traders, the cash account is an asset account by nature, and the capital account is an equity account by nature.

Social Intelligence (SI): the definition and basics

This is often driven by our desire for survival, a key component of the brain’s defence mechanism. We tend to respond to communications and interactions based on earlier memories or emotional tendencies. In the same way to person-centred therapists, transactional analysis therapists believe that transaction analysis accounting people have the freedom and responsibility to choose to become what they want to be.

Improved interpersonal relationships

Unproductive or counterproductive transactions were considered to be signs of ego state problems. Analyzing these transactions according to the person’s individual developmental history would enable the person to « get better ». Berne thought that virtually everyone has something Accounting Periods and Methods problematic about their ego states and that negative behaviour would not be addressed by « treating » only the problematic individual. This process is also referred to as script analysis, which analyses and explores our scripts developed in childhood. Scripts are unconsciously built beliefs and views we have of ourselves, others, and the world, which we developed to make sense of our internal and external environments from early experiences and interactions.

- For example, a surgeon will survey the patient, and based upon the data before him/her, his/her Adult decides that the scalpel is the next instrument required.

- Always seek advice from your physician or qualified mental health provider.

- Transactional analysis (TA) is a psychotherapeutic approach that examines interactions between individuals based on the premise that each person has three ego states that shape their communication and behavior.

- His studies took him in a different direction to Freud, but the ego states provided a firm foundation for him to develop his theories of the ‘Parent, Adult and Child’ states.

- Understanding ego states and transactional patterns fosters intentional and harmonious interactions, strengthening connections in romantic, familial, or friendship relationships.

- Knowing which ego state you and your opponent are in at a certain moment here and now can help you respond appropriately to a situation.

- This can happen when one person is dishonest or when two people communicate in a way that is harmful to one or both.

- It is important to note that although the phrase ‘complementary transactions’ sounds positive, it does not necessarily mean that this type of communication is always healthy communication.

- On the one hand, one person for instance starts as the Parent ego and the other as the Child ego.

- Unhealthy childhood experiences can lead to being pathologically fixated in the Child and Parent ego states, bringing discomfort to an individual and/or others in a variety of forms, including many types of mental illness.

- Information on both of these books can be found in the Bibliography page.

The core principle of TA is splitting the ego into three separate states. The three ego states correspond to people’s internal Parent, Child, and Adult models. Singer/songwriter Warren Zevon mentions transactional analysis in his 1980 song « Gorilla, You’re a Desperado » from the album Bad Luck Streak in Dancing School. Transactional analysis integrates the theories of psychology and psychotherapy because it has elements of psychoanalytic, humanist and cognitive ideas. In the early 1960s, he published both technical and popular accounts of his conclusions.

Books by Eric Berne (popular)

You may not have considered this much before, but when you are conversing with another person, the one who is talking could be said as giving the transaction between the two of you ‘stimuli and the other person is giving the ‘response’. He believed that human beings have three distinct attitudes or states of mind which he called ego states. Berne wanted to develop a therapy which was easier for the general public to understand. Berne believed that communication with others comes from three distinct parts of self which he called ego states. Transactional analysis is a type of psychotherapy developed by Canadian psychiatrist Eric Berne in the 1940s.

Transactional Analysis (TA) is a powerful psychological theory and method for understanding human behavior, communication, and relationships. Developed by psychiatrist Eric Berne in the 1950s and 1960s, TA provides a framework for analyzing social interactions and promoting personal growth. Here, we will explore the key concepts of TA and its applications in healthcare, therapy, and transactional analysis research. Transactional analysis (TA) is a psychotherapeutic approach that examines interactions between individuals based on the premise that each person has three ego states that shape their communication and behavior.